Net present value of future cash flows calculator

NPV Calculator Use this online calculator to easily calculate the NPV Net Present Value of an investment based on the initial investment discount rate and investment term. P V F V 1 r m m t where rR100 and is generally applied with.

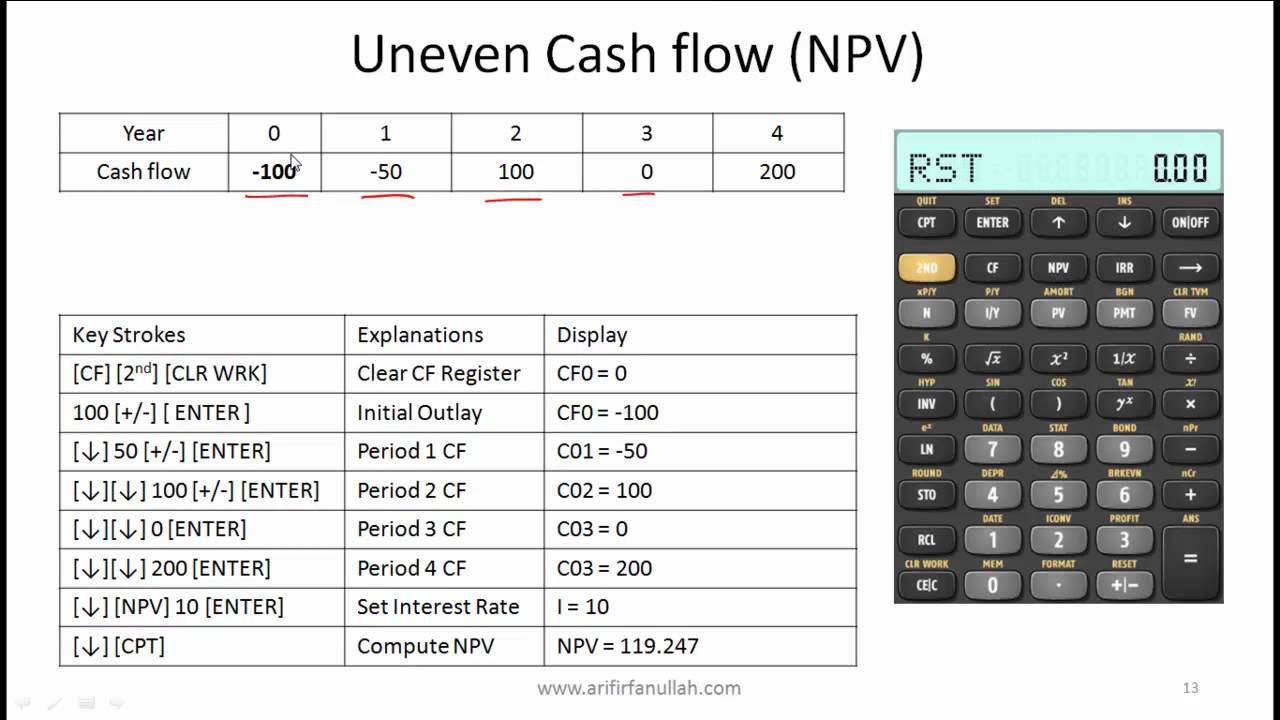

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Calculate the present value of all the future cash flows starting from the end of the current year.

. It simply subtracts the current cash outflows including the initial cost from the current cash flows over time. It helps in determining if it is worth pursuing an investment. Discover the net present value for present and future uneven cash flows.

Pressing calculate will result in an FV of 1060. Future Value Present Value x 1 Rate of Return Number of Periods Where. Rate of return is a decimal value rate of.

It is possible to use the calculator to learn this concept. Our Business Consultants Will Partner With You To Build Financial and Operational Success. Ad EY Corporate Finance Consultants Help All Types of Businesses with Key Financial Issues.

Net present value NPV is a method used to determine the current value of all future cash flows generated by a project including the initial capital investment. Use this calculator to determine Net Present Value of a series of cash flows. Includes dynamic printable year-by-year DCF schedule for sensitivity analysis.

Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time. Net Present Value NPV - Net Present Value NPV is a method of determining the current value of all future cash flows generated by a project after accounting for the initial capital.

Input 10 PV at 6 IY for 1 year N. Because we want net ie. Ad QuickBooks Financial Software.

In this case the Excel NPV function just returns the present value of uneven cash flows. Cash flows can be of any regular frequency such as annual semi annual quarterly or monthly. The NPV calculator considers the expenses revenue and capital costs to determine the worth of an investment or project.

We can ignore PMT for simplicitys sake. Learn What EY Can Do For Your Corporate Finance Strategy. Firstly you need to select a different cell D6 where you want to calculate the.

The rate used to discount the net present value is the time value. Present Value is a sum of money in the present. The present value of any future value lump sum plus future cash flows payments Present Value Formula for a Future Value.

Present value of future cash flows less initial investment. IRR does not show a significant implication on the cash flows. Because the time-value of money dictates that money is worth more now than it is in the.

Internal Rate of Return IRR is a percentage expression of the expected returns from an investment. Home financial present value calculator Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or. Rated the 1 Accounting Solution.

Net present value is the present value of all future cash flows of a project.

Market Vs Book Value Wacc In 2022 Accounting Basics Book Value Accounting And Finance

Pin On Personal Finance

Cash Flow Basics How To Manage Analyze And Report Cash Flow Cash Flow Statement Positive Cash Flow Cash Flow

Modified Internal Rate Of Return Mirr The Solution To Multiple Irr Positive Cash Flow Financial Management Accounting And Finance

Download Npv And Xirr Calculator Excel Template Exceldatapro Excel Templates Templates Cash Flow

Formula For Calculating Net Present Value Npv In Excel Excel Templates Proposal Templates Proposal Writing

Net Present Value Npv Financial Literacy Lessons Accounting Education Cash Flow Statement

In This Article We Are Discussing Discounted Cash Flow Analysis By Giving A Real Time Example Of A Company Lets Learn Its Components Cal Cash Flow Flow Cash

How To Use Discounted Cash Flow Time Value Of Money Concepts Time Value Of Money Money Concepts Finances Money

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

How To Use Npv Formula In Excel Excel Formula Excel Tutorials Excel

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Net Present Value Template Download Free Excel Template Excel Templates Templates Business Template

Present Value Of 1 Table Accountingexplanation Com Investment Analysis Financial Calculators Meant To Be

Present Value Calculator Npv Investment Advice Financial Independence Financial Calculators

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis